Home Depot Home Improver Card 2022 (How It Works + More)

|

|

Visa Inc. headquarters at Metro Center in Foster City, California

|

|

| Type |

Public |

|---|---|

| Industry |

Financial services |

| Founded |

September 18, 1958 ( 1958-09-18 ) (as BankAmericard) [1] Fresno, California , United States |

| Founder |

Dee Hock |

| Headquarters |

,

United States

|

|

Area served

|

Worldwide |

|

Key people

|

Alfred F. Kelly Jr. ( CEO ) |

| Products |

Credit cards Payment systems |

| Revenue |

US$ 21.85 billion (2020) [3] |

|

US$14.08 billion (2020) [3] |

|

|

US$10.87 billion (2020) [3] |

|

|

Total assets |

US$80.92 billion (2020) [3] |

|

Total equity |

US$36.21 billion (2020) [3] |

|

Number of employees

|

20,500 (2020) [3] |

| Website |

visa .com |

Home Depot has a lot to do with its success and popularity. Customers can get a variety of financing and reward options to save money while they shop at Home Depot.

Home Depot’s Improver Card (also known as the Consumer credit cards) is an exclusive payment option that was introduced in 2022. Customers may enjoy discounts or deferred interest without having to affect their credit score. Applications for the card are located online.

What is a Home Depot Home Improvement Card?

Home Depot Home Improver Card may be a better option than Citi, and is offered as a credit card.

You can use your Home Depot Home Improvement Card to purchase products and services in-store or online.

How Do I Get A Home Depot Home Improver Card?

Follow the provided instructions to apply for your Home Depot Home Improvement Card online.

It is important to note that you need to do a credit check before you can apply for a Home Depot Home Improver Card.

This credit check can be applied for for your Home Depot Home Improver Card. It will not affect your credit rating.

You can also check the Home Depot website for terms and conditions that will determine if your eligibility to receive a Home Depot Home Improver Card.

How do I activate my Home Improvement Card?

You can activate your Home Improver Card by visiting the website.

You will need to add your date of birth to prove your identity.

For assistance with activating your Home Depot Home Improver Card call customer service at 1-888-413-1083.

How do you get the Home Improvement Card benefits?

There are several benefits to the Home Depot Home Improver Card, especially when you want to begin a project.

Using the Home Improver Card will offer you a deferred interest on transactions over $299, which can be great for helping you to transform your home.

You can also get $25 off purchases between $25 and $299; $50 off purchases between $300 and $999; or $100 off bills over $1000.

The extended return period gives you the opportunity to exchange products for a greater amount of time. cardholders will have one year to return products, which is four times longer than the standard returns window.

Note that this extended time period doesn’t apply to products from the design centre.

Homeimprover Card has other rotating deals, such as 10% discount on a specific brand or 24-month financing to purchase certain items.

Is there a way to extend my financing?

Your Home Improvement Card can provide extended financing for purchases at Home Depot.

Different offers may change. For example, 12-months financing of fencing installation above $2500. You will also receive a shelving upgrade free of charge with 5% discount on certain purchases.

These offers may not be available at Home Depot for all periods. They are constantly updated on the Home Depot Website.

How can I manage my Homeimprovement Card?

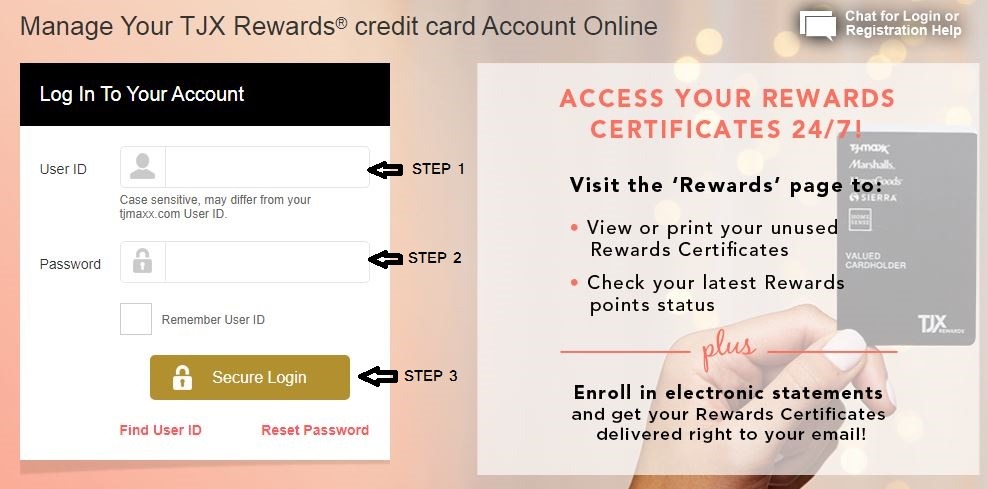

Home Depot offers a way to monitor your Home Improver Card. You can log in from any device at any time and see your Home Improver Card status.

You can also monitor and pay your bills. Additionally, receive special offers from your Home Depot Home Improver Credit Card.

How can I see my balance on the Homeimprover card?

Check the Balance of Your Home Depot Home Improver Card in-store as well as online.

Stop by your nearest Home Depot and ask for assistance at the Customer Service Desk. They will inform you of your current balance.

Alternatively, you can call Home Depot at (866-875-5488) and ask them to inform you about your Home Improver Card balance.

Other than that, you can also visit the Home Depot website for information about your balance as well as other services.

Do you know of any similar cards to The Home Improver Card Card?

Home Depot Project Loan Card allows for lending to home improvement projects.

The Project Loan Card allows Home Depot customers to borrow up to $55,000 for significant home improvement projects.

The card has a low APR (7.19%) for up to seven year. This card is a great alternative to the Home Depot Home Improvement Card, which can be used for bigger projects.

You now know all about Home Depot’s Improver card. We also have posts that discuss whether Home Depot offers a Senior Discount, Contractor Discount, or if Home Depot takes American Express.

Home Depot customers have the option to use their Home Improver Card as a credit card for home purchases, in-store and online. There is a deferred interest option for all transactions greater than $299

You can check your balance and status of your Home Depot Home Improver Card at any point online or by calling a customer helpline.

Application processes are similar to regular credit card applications. Credit checks will also be needed before an approval is granted. You should note that this check will not negatively impact your credit score.

Is There a Place I Can Use my Home Depot Home Improvement Cart Card?

Conclusion: Home Depot Home Improver card The Home Depot Home Improver is a credit-card that customers can use to purchase and complete home improvements in-store or online. For transactions above $299, it offers deferred interests.

How can I use my Home Depot Commercial Credit Card

Home Depot Business Credit Card is only available at Home Depot locations and HomeDepot.com

Can I repay my Home Depot Project loan earlier?

“With The Home Depot Project Loan we offer NO annual fee and you have the ability to pay off the loan at any time with no prepayment penalty.”

Is it possible to have a lower credit score by applying for the Home Depot Credit Card?

Yes, the Home Depot Credit Card does a hard pull credit check. The Home Depot Credit Card requires a credit score minimum of 640. This requirement is in line with the requirements for most store card cards. It is impossible to be prequalified for Home Depot Credit Card. An applicant’s credit score will drop 5-10 points if they have to do a hard pull.

.Home Depot Home Improver Card 2022 (How It Works + More)

![Can You Buy a Visa Gift Card With a Walmart Gift Card? [Guide]]( https://frequentmiler.com/wp-content/uploads/2013/01/MasterCard50Dollars_thumb.jpg)

![Can You Buy a Visa Gift Card With a Walmart Gift Card? [Guide]]( https://i0.wp.com/www.giftsinventory.com/wp-content/uploads/2021/04/cvs-gift-cards.png?fit=900%2C506&ssl=1)